Hi there, spreadsheet enthusiasts and other budget-conscious people! Are you looking for a simpler, less expensive way to manage payroll for your company because you’re tired of being buried under a mountain of paperwork? My friend, you’re going to be in for a treat!

What is Open Source Software?

Open source software is computer software whose source code is made publicly available, allowing anyone to view, use, modify, and distribute it. The term “open source” refers to the fact that the source code is freely available to the public, fostering a collaborative and transparent development process. This approach differs from proprietary or closed-source software, in which the source code is not made available to the public.

What is Payroll software?

Payroll software is the multitasking maestro that creates a streamlined symphony out of a complex web of payroll procedures. Time is saved, mistakes are reduced, the tax collector is avoided, and employers and employees are empowered. Give the payroll software a nod of gratitude the next time payday is almost here for its silent, magical work behind the scenes. Ultimately, the wizard is responsible for transforming the monstrous payday paperwork into a skillfully orchestrated dance of numbers and money.

What is Free Payroll software?

The unsung hero of the financial industry, free payroll software gives companies the necessary resources to handle payroll without breaking the bank. For pragmatic entrepreneurs, it’s an essential resource—a trusted ally that guarantees that payday is a time to celebrate, not stress about money. So the next time someone tells you that there’s no such thing as a free lunch, just nod and smile because there’s always a free savour to be had in the payroll software world.

Discovering complimentary payroll software is akin to discovering a golden pot at the far end of a financial range in the extensive realm of business, where every cent counts. But what exactly is this imagined being, and can it actually help your company, for free, to navigate the complex world of payroll? Let’s take a closer look at free payroll software.

Comparison Between Manual Payroll Processing and Payroll Software

Two powerful rivals enter the battlefield in the epic tale of payroll processing: payroll software, a modern and stylish rival, and manual payroll processing, the long-standing champion. Come watch this titanic battle unfold and discover how these guys differ when it comes to money.

Comparison Table Between Manual Payroll Processing and Payroll Software

| Aspect | Manual Payroll Processing | Payroll Software |

| Time Efficiency | Time-consuming, manual calculations and paperwork. | Automates calculations, significantly reduces processing time. |

| Accuracy | Prone to human errors such as miscalculations or data entry mistakes. | High accuracy due to automated calculations and data validation. |

| Compliance | Requires constant vigilance to stay compliant with changing tax laws and regulations. | Automatically updates to comply with the latest tax laws and regulations. |

| Record-Keeping | Relies on physical storage, making retrieval time-consuming. Risk of loss or damage to documents. | Digital storage and organization for easy retrieval, reducing the risk of document loss. |

| Employee Access | Limited access for employees, requiring interactions with HR for information. | Self-service features allow employees to access pay stubs and manage personal information |

| Cost | May seem cost-effective initially but incurs hidden costs in terms of time and potential errors. | Initial investment but cost-effective in the long run due to time savings and accuracy. |

| Scalability | Limited scalability as the workload increases, leading to potential bottlenecks. | Scalable to accommodate the growth of the company without compromising efficiency. |

| Learning Curve | Relatively easy to understand, but expertise is required for complex payroll scenarios. | User-friendly interfaces, reducing the learning curve. May require some training for advanced features. |

| Flexibility | Limited flexibility, especially in handling complex payroll structures or changes. | Flexible, allowing customization to adapt to various payroll needs and structures. |

| Audit Trail | Limited or manual audit trail, making it challenging to track changes and ensure accuracy. | Provides a detailed digital audit trail for transparency and compliance purposes. |

Top 10 Open Source Payroll Softwares in 2024

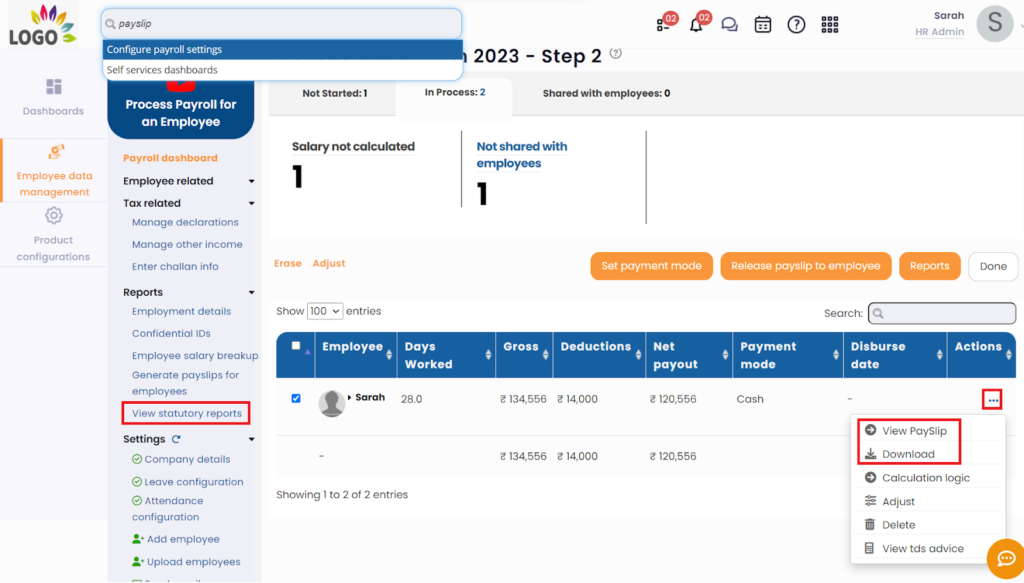

1. Odoo Payroll

Odoo is an open-source business application suite that includes modules for accounting, human resources, inventory management, CRM (Customer Relationship Management), and other business processes.

Prices-

Free & Paid Plans

Key Features-

- Accounting & CRM integration

- Comprehensive reports

- Employee self-service portal

- Multi-company & multi-country

Pros-

- Affordable: Open-source & Cheap

- Integrated: Seamless integration with other Odoo modules (e.g., CRM, accounting).

- Automated:

- Employee self-service

Cons-

- Limited reporting

- Limited scalability

- No customer support

- Localization limitations

- Learning curve

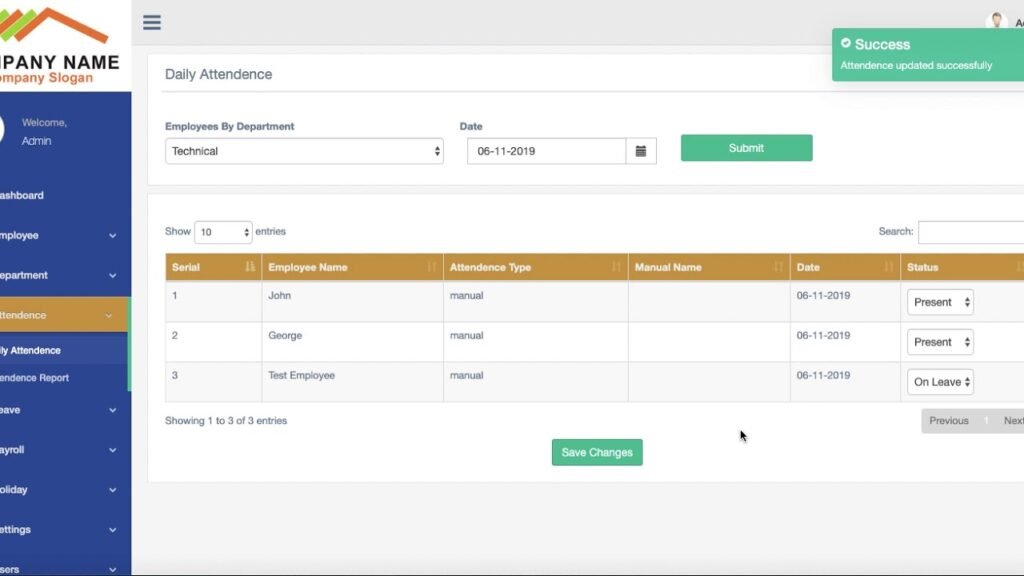

2. TimeTrex Community Edition

TimeTrex is a free and open-source workforce management software that includes time and attendance tracking, employee scheduling, and payroll processing.

Prices-

Free (with limitations)

Key Features-

- Time tracking & payroll integration

- Employee scheduling & leave management

- Basic reports & tax calculations

Pros-

- Free

- Ease of use

- Basic time tracking

- Mobile app

Cons-

- Limited features

- Data limitations

- Limited reporting

- Integrations

3. Empxtrack

Empxtrack is a cloud-based Human Resource (HR) and payroll software solution that aims to improve the efficiency of various HR processes, including payroll management.

Prices-

Free (with limitations)

Key Features-

- Customizable interface & workflows

- Advanced payroll calculations & deductions

- Multi-level user access control

- Mobile app availability

Pros-

- AI-powered

- Comprehensive features

- Customization

- Employee engagement

Cons-

- Pricing: Can be expensive.

- Complexity: steeper learning curve for some users.

- Integrations: May require additional setup or fees for integration.

- Reporting: Some users report difficulties while making reports.

4. PHP Payroll

A PHP payroll software is a payroll management system written in the PHP programming language. PHP (Hypertext Preprocessor) is a widely used server-side scripting language for web development.

Prices-

Free (self-hosted)

Key Features-

- Open-source and customizable

- Flexible tax configuration

- Integrates with other PHP applications

Pros-

- Cost-effective: Free and open-source, saving on licensing fees.

- Customization: Tailor-made for specific business needs and payroll rules.

- Integrations: Connects with existing accounting or HR systems.

- Compliance: Manual setup and updates needed for changing tax regulations.

- Support: Limited community support compared to paid solutions.

Cons-

- Limited features

- Development & Maintenance: Requires PHP development expertise for setup and maintenance.

- Security: Requires strong security measures

- Support: Limited community support

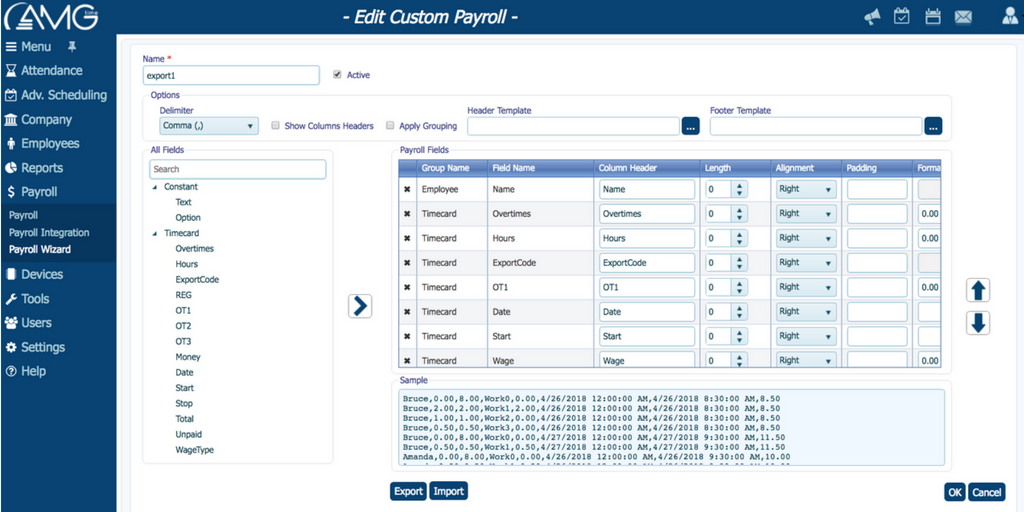

5. AMGTime

AMGTime is a time and attendance and workforce management solution that includes tools for tracking employee work hours, managing schedules, and processing payroll.

Prices-

Free & Paid Plans

Key Features-

- Cloud-based platform

- Employee time tracking, including GPS and geofencing tracking tools.

- Payroll integrations with over 120 payroll tools.

- Simple time tracking & payroll processing

- Automatic tax calculations & reports

Pros-

- Track, analyze, and improve training and racing performance

- Comprehensive data on pace, distance, heart rate, cadence, etc.

- Personalized training plans and feedback based on data

- Connect with other athletes and share workouts

- Freemium model with limited features, paid subscription for full access

Cons-

- Can be overwhelming for beginners

- Requires subscription for personalized coaching

- Only available on mobile app

- Can be expensive compared to other apps

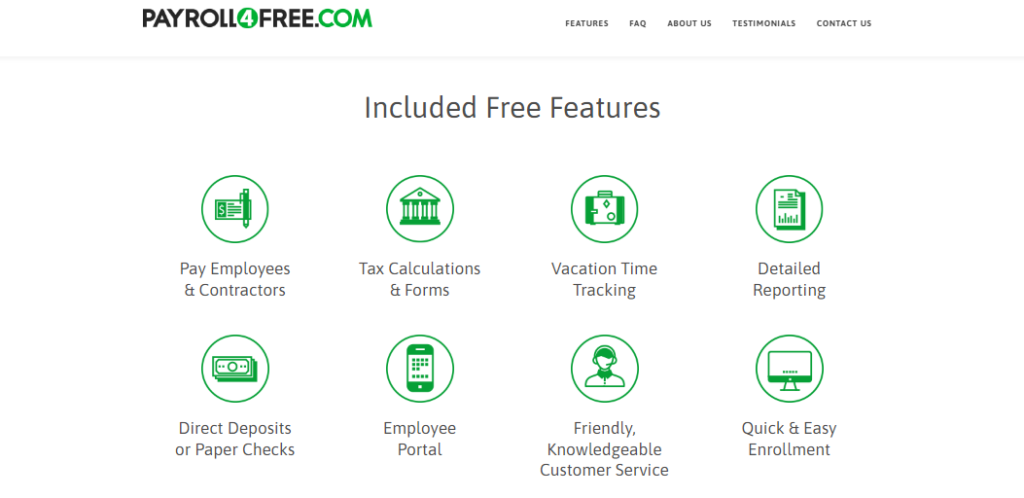

6. Payroll4Free.com

Payroll4Free.com provides small businesses with free online payroll software. The company provides a cloud-based solution that allows businesses to process payroll without having to pay for software.

Prices-

Free & Paid Plans

Key Features-

- Web-based and easy to use

- Basic payroll processing & tax calculations

- Employee data management

Pros-

- Free to use for up to 5 employees

- Simple and intuitive interface

- Basic payroll processing, tax filing, and reporting

- Limited support options

Cons-

- Limited features in the free plan

- Limited customization options

- No benefits administration or time tracking

- No phone support

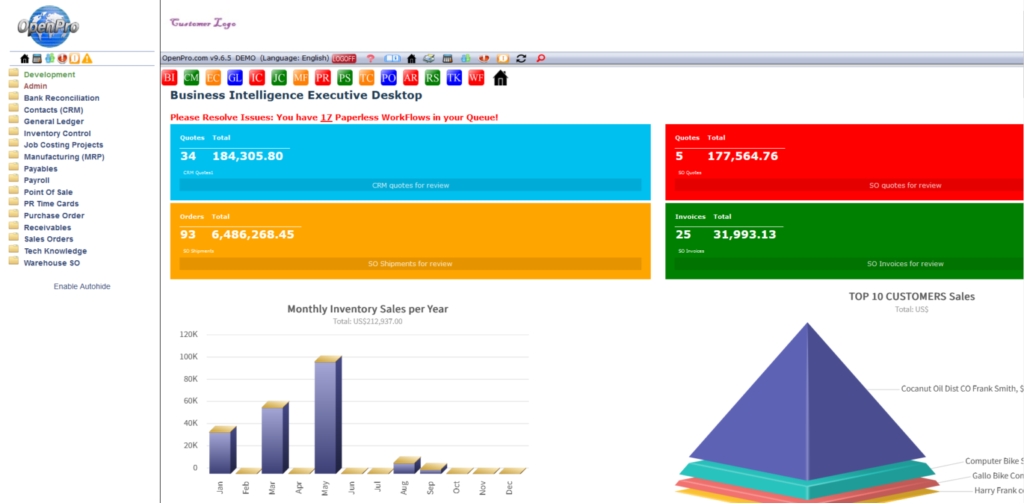

7. OpenPro

OpenPro Payroll Software is a module within the OpenPro ERP system, not a standalone product. It is a comprehensive software solution that includes Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), Payroll, Human Resource Management System (HRMS), Time Card management, and E-commerce features.

Prices-

Free & Paid Plans

Key Features:

- Energy management

- Automation

- Insights & Reporting

- Integrations

Pros:

- Cost-effective

- Scalable

- Customization

- Open platform

Cons:

- Learning curve

- Potential compatibility issues

- Limited support in free plan

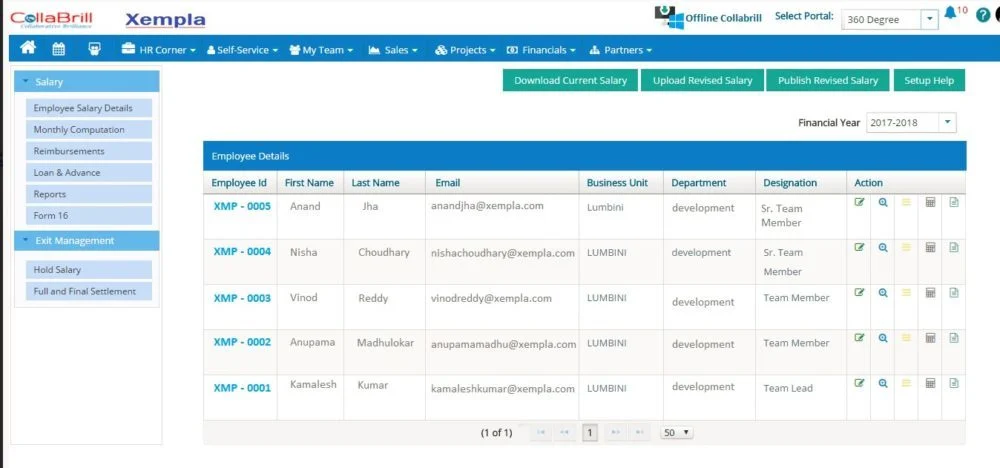

8. Collabrill:

Collabrill is more than just payroll software; it is an all-in-one HRMS platform with payroll as a key module. It is intended to simplify core functions for businesses of all sizes, with a focus on collaboration and usability.

Key Features:

- Real-time collaboration

- Built-in communication

- Version control

- Task management

- File sharing

Pros:

- Affordable: Free plan for basic needs, competitive paid plans.

- Easy to use

- Feature-rich

- Integrations: Connects with Google Drive and Dropbox.

- Mobile app: Work iOS and Android Apps.

Cons:

- Limited storage in free plan: Free users only get 10GB of storage.

- No advanced features in free plan: Paid plans offer features like custom branding and priority support.

- Can be overwhelming for some users

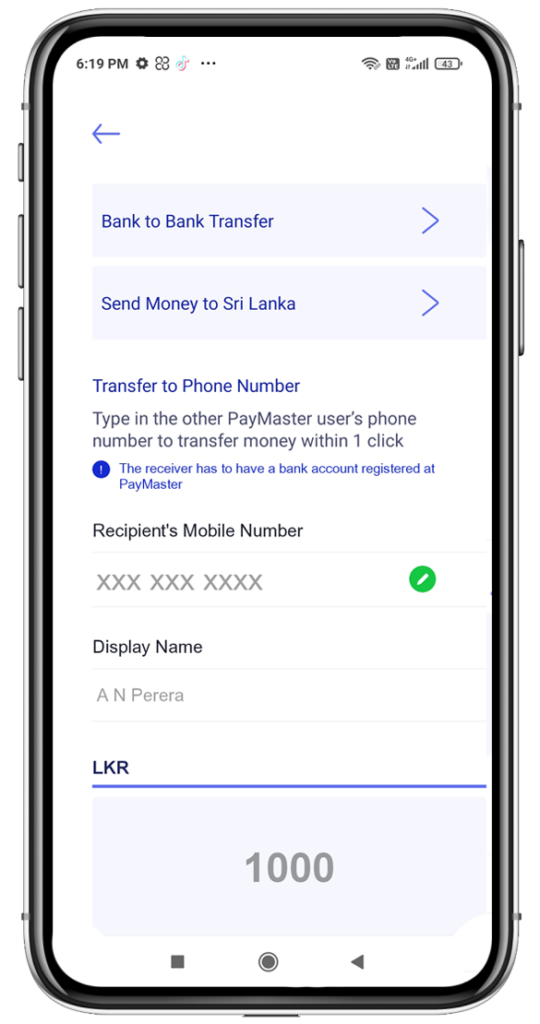

9. Paymaster(https://paymaster.com/)

The term “paymaster” usually refers to payroll software or a service that assists businesses in managing their payroll processes.

Price: Quote-based pricing, likely starting around $79/month + per-employee fees.

Key Features:

- All-in-one payroll.

- Automated tax filing

- Employee self-service

- Time and attendance tracking

- Reporting and analytics

Pros:

- Comprehensive: Handles all aspects of payroll from A to Z.

- Saves time and money

- Scalable

- Secure: Data is encrypted and stored securely.

Cons:

- Pricey: Can be expensive for small businesses.

- Not as user-friendly

- Limited customization

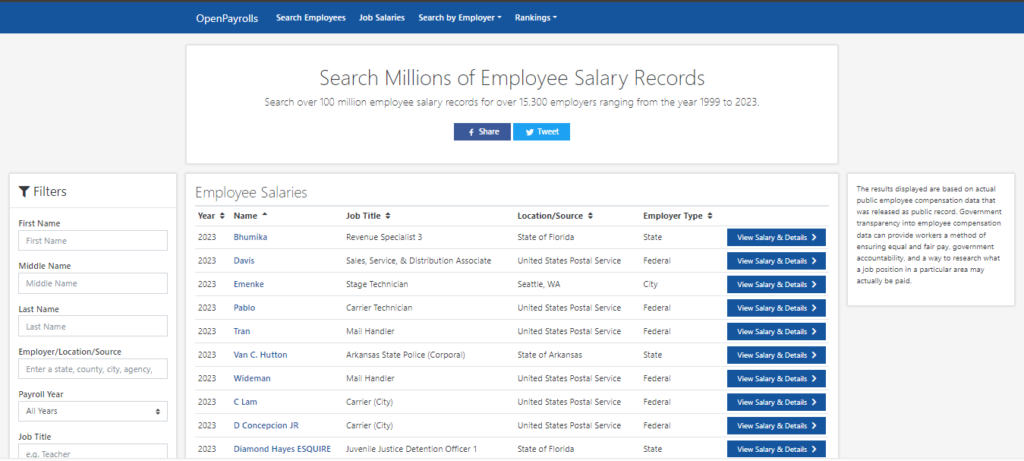

10. OpenPayrolls

OpenPayroll is a free and open-source payroll system that anyone can download and use. It’s written in PHP and is intended to be simple to install and use. OpenPayroll is a payroll management system that can be used by small businesses, non-profit organisations, and individuals.

Price: Free and open-source

Key Features:

- Basic payroll calculations: Salaries, deductions, taxes.

- Tax filing: Electronic forms generation and filing.

- Employee self-service

- Basic reporting: Payroll expenses, taxes, earnings.

Pros:

- Completely free

- Open-source

- User-friendly

- Sufficient for basic needs

Cons:

- Limited features

- Compliance responsibility

- Technical requirements: Needs web server hosting.

Recall that the secret is to identify and figure your unique requirements in order to select the open-source payroll software that best suits your company’s needs in terms of feature-to-feature ratio, usability, and affordability.